For any equipment rental operator, there is the necessary struggle of managing asset life cycles in order to optimize the balance for customer satisfaction, reliability, and cost control. This often comes hand in hand with a company’s asset replacement strategies – namely disposing older assets and replacing them with a fresh machine.

Over the course of the last 15 years, the notion of rehabbing assets has taken hold as a mechanism for extending rental useful life at a reasonable cost. However, along the way, the idea of investing in your assets has taken many forms and with the use of a wide range of vocabulary: refurbishment, repair, remanufacture, recondition etc. It can all become confusing when the terms may or may not have different meanings and when they are used interchangeably. The range of outcomes can vary from fresh paint / tires to a complete overhaul of the machine inclusive of a new engine and extended warranty. In this report, we will study the current accepted standards for reconditioning along with the added value these programs can bring to rental companies.

Firstly, what is it?

In the current state of the market, Rouse recognizes the term “reconditioning” as the generally accepted standard for overhauling a machine for extended life (sometimes termed “second life”). Although reconditing is observed for a wide range of products, this practice tends to be most commonly seen in aerial work platforms, namely telescopic booms. Rouse looks to the leading original equipment manufacturers (OEMs) of boom lifts as the benchmark for reconditioning work performed on these machines. The scope of work that the OEMs undertake tend to be the richest scope and meet their respective standards. This stands in contrast to work that might be performed at a third-party repair shop who may not otherwise undertake the full extent of the typical work order. The typical work orders for an OEM may include:

- Disassembly of the machine to its core

- Replacement or rebuild of the major components

- Boom inspections / repairs as needed

- Fresh paint consistent with new manufacturing standards

- New tires, new hoses

- New or rebuilt engine

- Full safety testing

- New warranty

With all of that working having been performed, the next logical question is, how does this add value?

There are certainly some interest value propositions offered by the reconditioning programs. For instance, a rental company can send their equipment for reconditioning (or buy already reconditioned units out of OEM stock) for a price point that can be significantly below the cost of acquiring a new machine. In many cases, a reconditioned machine can be utilized for 3-5 years beyond its original recondition date without material repair or maintenance needs. Because the OEMs offer warranties as long as 36 months, this gives rental companies comfort in knowing the product is fully covered and supported by the OEM. In turn, this translates into an extended rental life where by the rental companies are earning rental revenue streams on the same asset.

Although there are many good reasons for investing in reconditioning programs, rental companies should be aware of the impact on secondary market values for their reconditioned equipment. Over the course of several years, Rouse has had the opportunity to collect and evaluate a deep pool of data for reconditioned assets that have been put into rental fleets and subsequently sold into the secondary market. This information comes to Rouse via its relationship with over 150 rental and OEM dealer customers, all of which provide Rouse with their detailed fleet data. From this fleet data, Rouse has had the opportunity to identify reconditioned assets, validate the nature of the recondition work performed, and analyze the sales observations for purposes of assigning values to these machines.

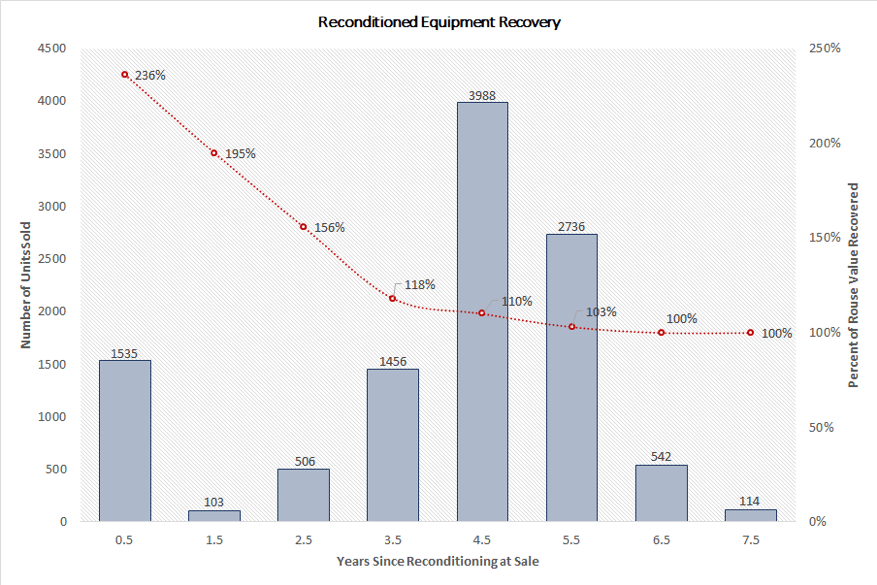

What is observed is that the average premium that is earned by a reconditioned asset, in comparison to an equivalent make-model-year asset that has not been reconditioned, starts high but erodes fairly rapidly in the first three years. After approximately four to five years into its “second life”, the market attributes little if any incremental value to reconditioned assets over their un-reconditioned counterparts. In part, this is explained by the fact that market participants are unlikely to know if an asset was reconditioned to begin with, and in the cases where it is known, the assets may not look or operate materially differently from those that have not been reconditions. The below chart is a pictorial representation of the average premiums observed from recondition date to the point where the premium erodes.

Recent Comments